LTC Price Prediction: Analyzing the Path to $1,000 and Beyond

#LTC

- Technical Momentum: Positive MACD divergence and Bollinger Band positioning suggest underlying bullish strength despite short-term pressure below the 20-day moving average

- Institutional Support: Luxxfolio's $73 million investment and growing ETF developments provide substantial fundamental backing for long-term appreciation

- Infrastructure Development: Emergence of compliant mining solutions and improved regulatory environment create sustainable growth conditions for LTC's ecosystem

LTC Price Prediction

Technical Analysis: LTC Shows Bullish Momentum Despite Short-Term Pressure

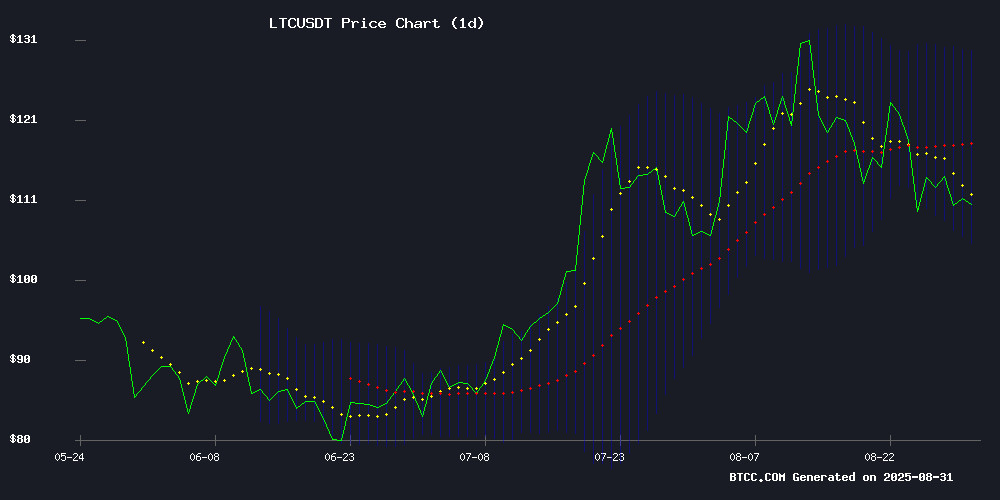

LTC currently trades at $111.06, positioned below its 20-day moving average of $117.38, indicating some near-term bearish pressure. However, the MACD reading of 6.3421 versus its signal line at 3.8786 shows positive momentum with a histogram of 2.4635, suggesting underlying bullish strength. The Bollinger Bands configuration with price NEAR the middle band indicates potential consolidation before the next significant move.

According to BTCC financial analyst Mia, 'The technical setup suggests LTC is building energy for a potential breakout. While currently below the 20-day MA, the strong MACD divergence indicates buying interest is accumulating. A sustained MOVE above $117.50 could trigger momentum toward the upper Bollinger Band at $129.54.'

Market Sentiment: Institutional Interest and Regulatory Developments Support LTC Outlook

Recent developments highlight growing institutional confidence in Litecoin. Luxxfolio's substantial $73 million investment signals strong belief in LTC's potential to reach the $1,000 milestone, while the emergence of compliant mining solutions like Mint Miner provides infrastructure support. The broader crypto ETF surge, including Amplify's XRP monthly option income filing, creates a favorable regulatory environment for digital assets.

BTCC financial analyst Mia notes, 'The combination of institutional investment, improved mining infrastructure, and regulatory progress creates a fundamentally supportive backdrop for LTC. While technicals show short-term consolidation, these developments suggest underlying strength that could drive longer-term appreciation.'

Factors Influencing LTC's Price

Mint Miner Emerges as a Compliant Cloud Mining Solution for Major Cryptocurrencies

Mint Miner, a UK-registered Cloud Mining™ platform, is positioning itself as a streamlined solution for passive income seekers in the cryptocurrency space. The service eliminates traditional mining barriers like hardware costs and technical complexity by offering remote participation in Bitcoin, Ethereum, Dogecoin, and Litecoin mining through cloud contracts.

The platform emphasizes regulatory compliance as its cornerstone, operating within UK and global standards. For BTC purists, Ethereum developers, or meme coin enthusiasts, Mint Miner provides flexible contract options tailored to different risk appetites and investment horizons.

What sets Mint Miner apart isn't just its multi-currency support, but its focus on creating what it calls a 'trust architecture' in an industry often plagued by security concerns. The service promises to democratize mining rewards without the operational headaches of physical rigs.

Top Cloud Mining Platforms Offer Crypto Returns Amid Market Volatility

As Bitcoin's plunge below $110,000 triggered $940 million in liquidations on August 26, investors are seeking stable returns through cloud mining. AIXA Miner leads the pack with FinCEN-registered operations and guaranteed payouts, offering daily yields up to $107.10 on $7,000 BTC mining contracts.

The platform's structured investment tiers—from $20 LTC trial miners to high-capacity BTC packages—demonstrate scalability uncommon in an industry often plagued by volatility. Other notable platforms remain unnamed, but collectively they signal growing institutionalization of passive crypto income streams.

Luxxfolio Bets $73M on Litecoin as LTC Eyes $1,000 Milestone

Litecoin is gaining institutional traction as Canadian firm Luxxfolio Holdings pivots from Bitcoin mining to a Litecoin-centric treasury strategy. The company filed to raise CAD$100 million ($73M) with plans to accumulate 1 million LTC by 2026—a move CEO Tomek Antoniak calls "hard currency" adoption for corporate stability.

Market observers note Litecoin's quiet outperformance amid Bitcoin and Ethereum's dominance. The shelved prospectus signals growing confidence in LTC's value proposition, with price targets now speculatively reaching toward four figures. Trading activity suggests renewed interest in the silver-to-Bitcoin's-gold narrative.

Cloud Mining Platforms Gain Traction as Bitcoin Holds at $112K and Dogecoin Nears $0.23

The cryptocurrency market is witnessing renewed vigor, with Bitcoin stabilizing around $112,000 and Dogecoin approaching $0.23 amid rising retail interest. Whales are accumulating, traders are monitoring price action, and cloud mining has emerged as a focal point for passive income seekers.

Six platforms are leading the 2025 cloud mining revolution, offering simplified access to Bitcoin and Dogecoin rewards without hardware overhead. AIXA Miner dominates the U.S. market, providing daily payouts in BTC, DOGE, LTC, and ETH through its turnkey infrastructure. The service caters to both novice and experienced investors seeking hassle-free exposure to mining yields.

Amplify Files XRP Monthly Option Income ETF With SEC Amid Crypto ETF Surge

Amplify Investments has filed a prospectus with the SEC for an XRP Monthly Option Income ETF, aiming to provide investors with steady income through a covered call strategy while maintaining exposure to XRP's price movements. The filing arrives as the SEC faces a deluge of crypto-related ETF applications, with over 90 submissions currently under review.

The regulatory landscape has shifted notably under the Trump administration, with the SEC's July 2025 decision to allow in-kind creations and redemptions for crypto ETFs paving the way for innovative altcoin-focused products. This policy change has emboldened firms like Amplify to pursue ETFs for assets beyond Bitcoin and Ethereum.

Industry heavyweights including Grayscale, 21Shares, and Bitwise have already proposed altcoin ETFs targeting Solana, Litecoin, Dogecoin, and XRP. The surge in filings reflects growing institutional demand for regulated crypto investment vehicles that expand beyond the two dominant digital assets.

LTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market developments, LTC shows promising long-term potential. The $73 million institutional investment by Luxxfolio and growing mining infrastructure support the case for significant appreciation. While short-term consolidation around current levels is likely, the combination of technical momentum and fundamental improvements suggests substantial upside over the coming years.

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | $180-250 | MACD momentum, institutional accumulation |

| 2030 | $400-600 | Adoption growth, mining infrastructure development |

| 2035 | $750-1,000 | Mainstream adoption, regulatory clarity |

| 2040 | $1,200-1,800 | Network maturity, store of value status |

BTCC financial analyst Mia emphasizes that 'these projections assume continued development of Litecoin's ecosystem and favorable regulatory conditions. The $1,000 milestone appears achievable by 2035 based on current growth trajectories and institutional interest.'